It's crucial to focus on the IIoT adoption for preventative maintenance

The industrial internet of things (IIoT) in the maintenance field has developed rapidly in recent years. According to a recent report, the IIoT adoption for preventative maintenance (PM) was expected to increase from 6.0 billion dollars in 2021 to 28.4 billion dollars in 2027, at a compound annual growth rate of 27.6%. This growth reflects PM's status as one of the IIoT's most valuable applications. The IIoT adoption performs well in maintenance operations. For example, Honeywell's IIoT-based PM system helped Cathay Pacific reduce flight delays by 51\%. Additionally, IIoT-based PM was estimated to generate about 3 billion dollars of savings for the aviation industry. Hence, a growing number of leading manufacturers in the complex equipment industries have started to build IIoT-based platforms for PM, such as Skywise of Airbus, Predix of General Electric (GE), and RootCloud of Sany. Such IIoT-based platforms for PM in the complex equipment industries reshape the market pattern, prompting manufacturers to adjust their business strategies accordingly. Currently, there is a lack of detailed analysis on the impacts of IIoT-based platforms for PM. Furthermore, manufacturers' operational strategies for IIoT-based platforms deserve more attention to help firms and policymakers better capture trends in IIoT.

Manufacturers’ operational strategies about the IIoT adoption

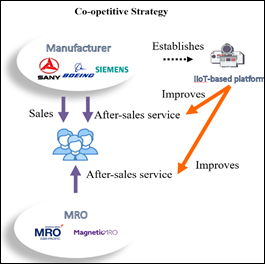

The existence of IIoT-based platforms presents manufacturers with a choice of strategy. Manufacturers can introduce improved IIoT-based services to compete against independent maintenance, repair, and operations firms (MROs). For example, Komatsu stands out from the competition by providing efficient after-sales service for its heavy construction equipment through the remote monitor platform. On the contrary, manufacturers can pursue a “co-opetitive” strategy by opening their IIoT-based platforms and sharing predictive information with MROs, in return for a royalty fee. For example, BMW grants third-party service providers access to the telematics data of their CarData platform in return for a unit flat fee. Hence, manufacturers must carefully decide whether to pursue a competitive or co-opetitive strategy in order to accommodate the platform ecosystem. Figure 1 shows the cases of manufacturers’ IIoT adoption for PM.

Figure 1. Cases of Manufacturers’ IIoT Adoption for PM

Manufacturer’s decisions about the adoption of the IIoT-based platform are essential

In the complex equipment industries, although many manufacturers have adopted the IIoT for PM to better seize the after-sales service market, there still exist several manufacturers that insist on complementing regular PM activities. Moreover, with the IIoT adoption, some manufacturers, like Tesla, adopt the competitive strategy of limiting MROs' access to its IIoT-based platform, whereas others, like Airbus, adopt the co-opetitive strategy of providing MROs access. Hence, the decision about the IIoT adoption for PM is still in argument. The IIoT-based technological innovation presents manufacturers with an opportunity to improve the efficiency of maintenance operations, but it requires them to invest resources in the project and adjust the subsequent business strategy. Although existing studies have considered a firm's decision on the bundle of sales and after-sales service in the traditional environment, the strategies of a manufacturer for the IIoT-based platform and related business operations remain unexamined. Our study aims to answer these questions and provide critical insights for firms and policymakers.

We introduce a game-theoretical model to solve firms’ decisions about the IIoT adoption

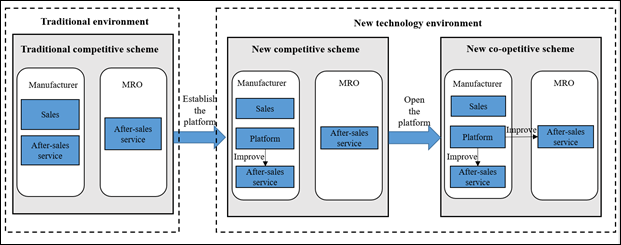

Our study constructs a game-theoretical model to outline the manufacturer’s three scheme options for the IIoT adoption: (i) traditional competition (TM) scheme, where the manufacturer does not establish the platform, and both the manufacturer and MRO conduct regular PM; (ii) new competition (NM) scheme, where the manufacturer establishes the platform and improves its PM, and the MRO conducts regular PM; (iii) co-opetition (NP) scheme, where the manufacturer establishes and opens the platform, and the MRO accesses it, making both firms improve PM. By using backward induction, we derive the equilibrium profits of the manufacturer and MRO under each of the three schemes and solve the final game equilibrium. According to the line of inquiry, our work first identifies the manufacturer's decision whether to establish an IIoT-based platform for PM, and then analyze its decision whether to open the platform to the MRO. Subsequently, our study judges whether the manufacturer should pay less technology investment with an open platform than it would with a closed platform, and analyze whether the manufacturer's IIoT adoption hurts the MRO. Finally, our research investigates the impacts of the IIoT-based platform on firms' pricing, customer surplus, and social welfare. Figure 2 shows the research framework about the manufacturer’s IIoT adoption.

Figure 2. Research Framework about the Manufacturer’s IIoT Adoption

Our main contributions

Our study contributes to the existing literature by analyzing the decisions of a manufacturer to invest in the IIoT-based platform and the business strategy in the presence of an independent MRO. Our work considers the interactions among sales, after-sales service, and the introduction of an IIoT-based platform, offering important implications on the research paradigm for scholars to investigate novel business operations. By including the operational characteristics of the platform and the complementarity between the product and after-sales service, our work builds a new model framework that incorporates the manufacturer's IIoT adoption and service transformation. Our work provides a new perspective to the research on service operations and co-opetition. Our results show that the manufacturer's decisions on the investment in the IIoT-based platform and subsequent operational strategy are critical in the platform ecosystem. These results broaden the knowledge and theory for digital transformation and service-oriented manufacturing.

The managerial implications

Our study helps firms and policymakers stay abreast of the platform ecosystem. Through analyzing the strategies pursued by the manufacturer and MRO, we discover some useful managerial implications. First, we show that with the establishment of the platform, the manufacturer with stronger PM capability has an incentive to invest more in PM to achieve fewer product failures and reach higher profitability. Our results suggest that GE should sharpen the focus of Predix on the industries in which firms have stronger PM capabilities, such as the aviation industry. Next, we suggest that in industries where firms have relatively strong PM capabilities, manufacturers (e.g., Boeing) could consider allowing MROs to access their platforms. Moreover, we investigate the manufacturer's investment decision with the opening of the platform. Our results reveal an important implication for the MRO that the manufacturer's adoption of an open platform can lead to a win-win equilibrium. It is suggested that in industries where manufacturers open the platforms (e.g., Airbus in the aviation industry), MROs (e.g., Lufthansa Technik) should collaborate with manufacturers to access the platforms and improve PM efficiency. Further, we find that the adoption of a closed IIoT-based platform may sometimes decrease social welfare. Our results suggest that policymakers should encourage manufacturers with stronger PM capabilities to develop platforms. In addition, we find that the manufacturer's adoption of an open platform can be detrimental to customers, since it stimulates the manufacturer to derive more customer value. However, we also find that the adoption of an open platform still generates more social welfare. In this perspective, policymakers could consider providing subsidies for customers.

Article Information

Jun Pei, Ping Yan, Subodha Kumar. No Permanent Friend or Enemy: Impacts of the IIoT-based Platform in Maintenance Service Market. Management Science, 2023, DOI: 10.1287/mnsc.2023.4733.