1. Depicting credit risk over time is imperative

With the ability to depict the creditworthiness of borrowers, credit risk evaluation helps improve returns and financial stability and thus is undoubtedly of major concern for both financial institutions and individual investors. From the market perspective, with the explosive growth of fintech, innovative business models, such as marketplace lending and crowdfunding are constantly emerging. Such financial initiatives increase credit accessibility immensely and expand consumer groups but inevitably bring in more uncertainty (e.g., subprime borrowers) and thus greatly intensify the need to depict the dynamic risk profiles of market participants over time. From the business perspective, credit risk management runs through the entire life cycle of the loan business, and default prediction is accordingly carried out at different stages to support distinct decisions (e.g., granting loans at the pre-loan stage and risk warnings at the post-loan stage). At the pre-loan stage, deciding whether to grant credit to an application is the core goal. With the growth of financial markets, this goal has gradually shifted toward choosing loans or portfolios of high profitability, hence further requiring the assessment of how the credit risk of a borrower might evolve over time since the profitability of a loan depends on not only whether but also when the borrower will default. Moreover, knowing when a borrower will default can help lenders (e.g., banks) tap into the potential for earning growth (e.g., identifying extra profitable applications) and maintaining customer relations. At the post-loan stage, risk monitoring and control are the core goals and are generally supported by re-predicting whether a borrower will default based on additional repayment information or passively waiting for the occurrence of delinquency. A more effective method would be to differentially manage customers by mastering their risk levels at any given time.

2. Challenges for Multiperiod Loan Default Prediction

As single-period default prediction (SPDP) lags behind the practical needs for dynamic evaluation, we call for a new avenue, i.e., multiperiod default prediction (MPDP). As a more complex task, MPDP inevitably entails some challenges. We identify two essential challenges, in particular. First, borrowers always need to survive for a certain period before they can default in the next period—i.e., since the default probability of a borrower is monotonic over time, how to accommodate such monotonicity is a crucial challenge for MPDP. Second, as the information used for credit scoring is becoming more extensive and complex (Wang et al., 2020), the modeling process of credit scoring necessarily involves complex relationships (e.g., nonlinear dependencies), posing another challenge.

3. We propose a novel MPDP method

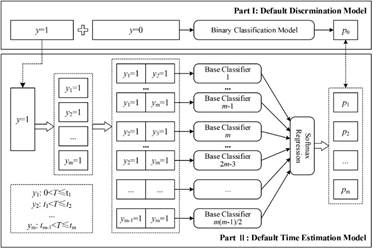

To address the challenges of MPDP, we propose a hybrid and collective scoring (HACS) approach in this design science research. HACS consists of two components: a default discrimination model, predicting whether a borrower will default in the full observation period, and a default time estimation model, predicting the default probability in each observation interval (i.e., when a borrower will default). The two components are synthesized through a probabilistic framework, which ensures the monotonicity of the output. Such a hybrid modeling design helps to distinguish the influences of features on whether and when a borrower will default, thus allowing for the learning of a more flexible model. Further, to accommodate complex relationships, we keep base classifiers assumption free (i.e., totally data driven) and design meta-learning to consolidate their predictions. HACS is distinctly different from the existing credit scoring methods that could be adapted to MPDP, including survival analysis and multi-label learning methods. Survival analysis methods can predict the monotonic default probability over time but rely on restrictive assumptions (e.g., proportional hazards) and are not amenable to directly accommodating complex nonlinear dependencies. Multi-label learning methods are more flexible but cannot guarantee the monotonicity of predicted default probability over time. HACS synthesizes the monotonicity property and flexible learning ability for dynamic credit scoring.

Figure 1. The Proposed HACS Approach

4. Main contributions

We contribute a new MPDP method for credit scoring to the literature. The MPDP research stream follows two avenues: one adopts the statistical modeling paradigm through survival analysis and the other adopts the machine learning paradigm through multi-label learning. We reveal a new avenue of MPDP in the middle of the two existing avenues by synthesizing their advantages. HACS is data driven and free from assumptions on survival time, which hinder the performance of survival analysis methods in financial risk analytics. HACS allows for the prediction of default probability monotonically over time, thus alleviating the downsides of multi-label learning methods, which focus on local fitting and ignore the global relevance and monotonicity constraint, rendering them effective for theoretical verification (i.e., discrimination performance) but problematic for practical verification (i.e., they are unable to accurately identify the default time). HACS models default status and default time separately and synthesizes them through a probabilistic framework, allowing for the differentiation of the feature influences regarding whether and when a borrower will default, thereby helping to better split and fit the complex relationships embedded in credit data.

Figure 2. Illustration of Multiperiod Default Probability Predictions

5. Practical Implications

For financial institutions, granting loans is the fundamental profitable business of financial institutions such as banks, and credit scoring tools like HACS may facilitate financial institutions in granting loans more effectively. First, depicting the risk profile over time enables financial institutions to implement fine-grained risk stratification beyond simply whether a borrower will default. Second, HACS may help financial institutions acquire and maintain potentially profitable customers to a greater extent to meet such emerging industry demand. Third, HACS may provide a more accurate decision basis for estimating expected losses, as their components, such as exposure at default, may be highly correlated with default time. For post-loan management, knowing whether and when a customer will default can help financial institutions carry out post-loan risk control in a timely matter and retain the customer by adjusting the line of credit. For individual investors, we provide individual investors with a straightforward and effective index, i.e., the expected return rate, to select loan portfolios with maximum expected return rates, considering both default losses and default-risk-free returns (i.e., interest rate). We recommend that investors adopt our proposed method, i.e., the ERR strategy using HACS, to select loan portfolios and that they further diversify their selected portfolios with the proposed optimization model based on modern portfolio theory.

Article Information

Zhao Wang, Cuiqing Jiang, & Huimin Zhao. (2023). Depicting Risk Profile over Time: A Novel Multiperiod Loan Default Prediction Approach. MIS Quarterly, 47(4), 1369-1399.